Affluent clients don’t just want personalization; they expect it. From streaming services to shopping carts, they’re surrounded by tailored experiences, so interactions with their wealth manager should be no different. Every client interaction, from onboarding to review meetings, is an opportunity to deliver relevance or risk losing resonance.

What once passed as sophisticated—segmentation, targeted messaging, behavior tracking—is now table stakes. Fortunately, modern fintech enables high-touch service at scale, allowing advisors to meet rising expectations without adding friction.

Here’s how firms are redefining engagement and why personalization is now essential.

Why Segmentation Falls Short

Segmentation organizes clients by shared characteristics, such as life stage or profession. Personalization goes further, adapting services and communications to reflect each client’s goals, preferences, and evolving circumstances.

Advisors still relying on demographic buckets are missing nuanced client behaviors that are hiding in plain sight. According to Capgemini, while 71% of high-net-worth individuals expect personalized offerings, only 39% feel that their wealth manager is delivering them. This gap between expectation and delivery represents both a risk and an opportunity.

Personalization Across the Client Lifecycle

Personalization is more than messaging, as it shows up across the client lifecycle, starting from day one and evolving throughout the relationship:

- Onboarding: Dynamic digital journey that adjusts in real-time based on client inputs.

- Portfolio Reporting: Curated dashboards aligned with each client’s financial fluency.

- Review Meetings: Behavioral data, including logins, clicks, and search queries, guide timely, relevant conversations.

The Engine of Engagement

Great data drives this personalization. McKinsey & Company reports that financial services firms leading in data-driven personalization see a 20% increase in client satisfaction and a 10–15% lift in revenue conversion rates. Personalization drives engagement, fosters trust, and ultimately leads to action.

In the wealth management space, this can take many forms, including

- Anticipating client needs by using predictive analytics to surface next-best actions based on engagement data

- Delivering timely content and customizing updates via client portals and apps to match individual preferences

- Staying responsive by sending alerts tied to specific holdings or market movements that affect each client

Loyalty Through Relevance

Personalized experiences also build trust, which in turn leads to loyalty. Coniq found that 91% of consumers are more likely to do business with brands that remember and recognize them. When clients feel truly seen—not just as portfolios, but as individuals—they tend to stay and recommend the service to their friends.

With $84 trillion in generational wealth poised to shift by 2045, Cerulli Associates found that younger, digital-native clients will expect seamless, tailored service. For example, one advisor built a birthday dashboard that delivered college fund updates alongside birthday greetings. It demonstrated how thoughtful, relevant technology can create moments that deepen trust and build relationships with the heirs who stand to inherit your clients' wealth.

Enabling Personalization at Scale

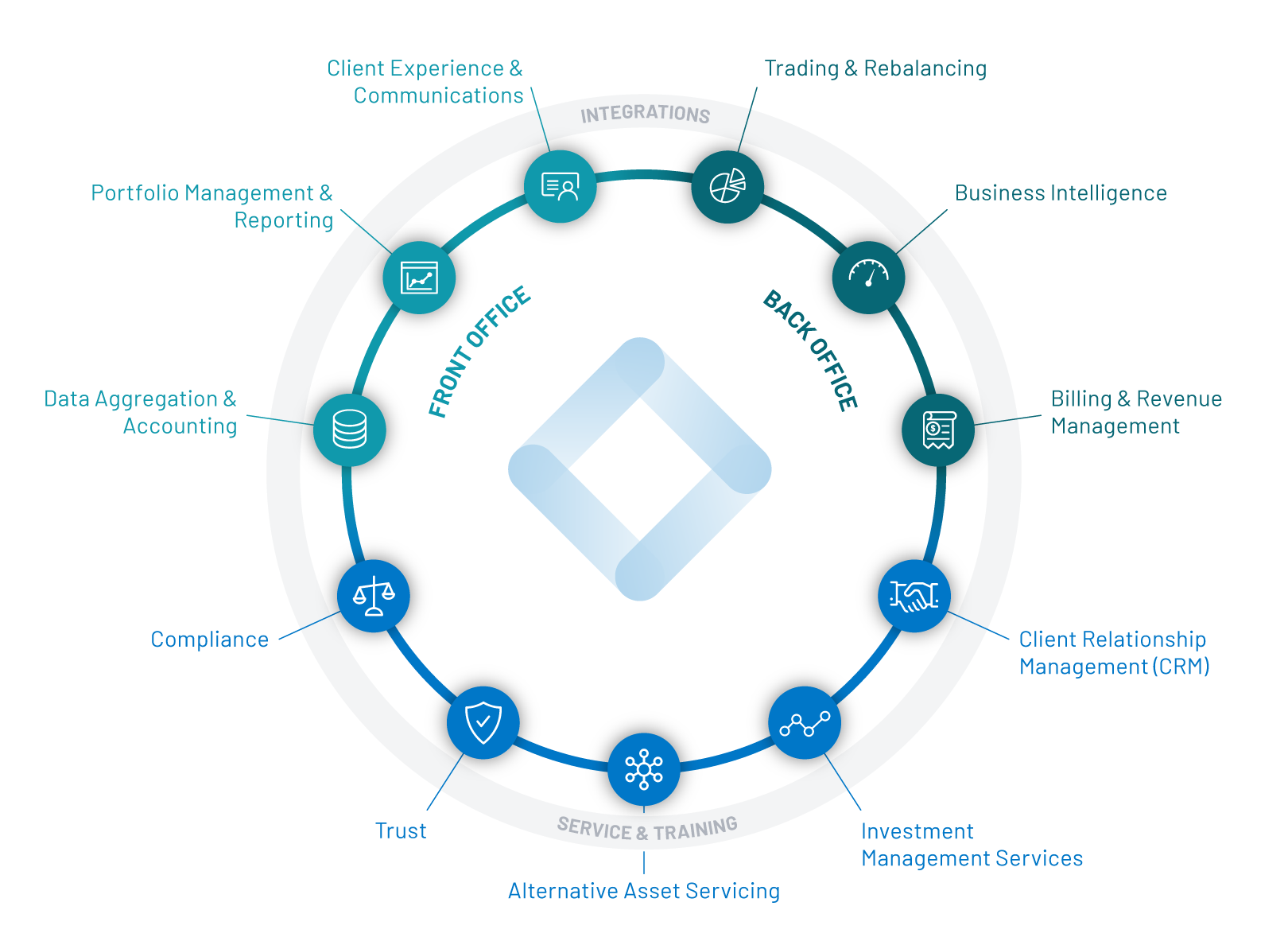

Personalization is the new baseline. To stay competitive, firms need unified, intelligent platforms, structured data foundations, and tools that support, rather than hinder, internal workflows.

SS&C Black Diamond® Wealth Solutions is purpose-built for this era. Black Diamond won the Family Wealth Report’s 2025 Award and Wealth Tech America’s 2025 and 2024 Awards for its robust and customizable reporting. With flexible client portals, behavioral insights, reporting customization, and CRM options specifically designed for the wealth management space, Black Diamond empowers firms to treat every client like their only client.

To learn more about how Black Diamond’s award-winning reporting can help you meet your clients’ demands for personalization, call us at 1-800-727-0605, email us at info@sscblackdiamond.com, or request your personal demo.